Get the Full View™ of the Wellness Market with NIQ Total Wellness

Your time is best spent growing your business, not wrangling data and pulling reports. NIQ has 1-click analytics, with the flexibility and efficiency you need to analyze your business with weekly data refreshes!

Here are a few ways we can help you grow:

- Full Market Visibility – Byzzer provides open access to the full NielsenIQ retailer portfolio and every single market, that’s over 1000+ markets, including channels, retailers, regions, divisions, state lines, plus exclusive Whole Foods Market coverage.

- Comprehensive Panel Data – Gain access to best-in-class retailer measurement POS data and the gold standard of shopper behavior data via our NIQ household panel, included in all Byzzer subscriptions! We offer more than 5 million UPCs coded for health and wellness characteristics – 10x the amount of the competition.

- Price – With a system built from the ground up, designed specifically for emerging and scaling businesses, NielsenIQ will save you up to 15% when you switch to Byzzer.

Get Free Data Today!

Sign up for an account to get 3 free reports including:

- Category performance and brand trends

- Top 10 lists

- Competitor comparison

- Weekly email alerts on category and brand pricing, market share, or market performance

Download Free NIQ Wellness Infographics

No matter what industry, category, or retailer your brand is in, we have the data and expert insights and product-level attribute tracking to help you craft the perfect Formula for Growth. Here are some free infographics fro you to use when crafting your own formula for growth:

What’s Happening in Baby Care?

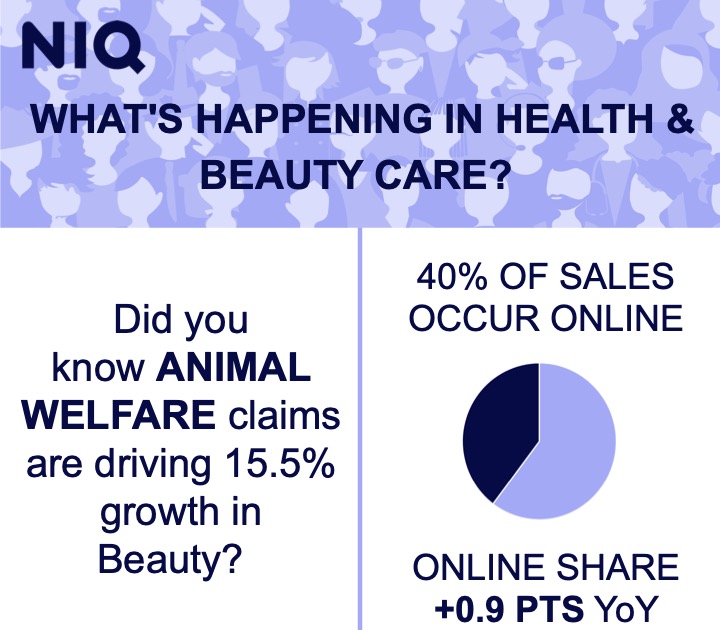

What’s Happening in Beauty?

What’s Happening with Beverages?

What’s Happening in Dairy?

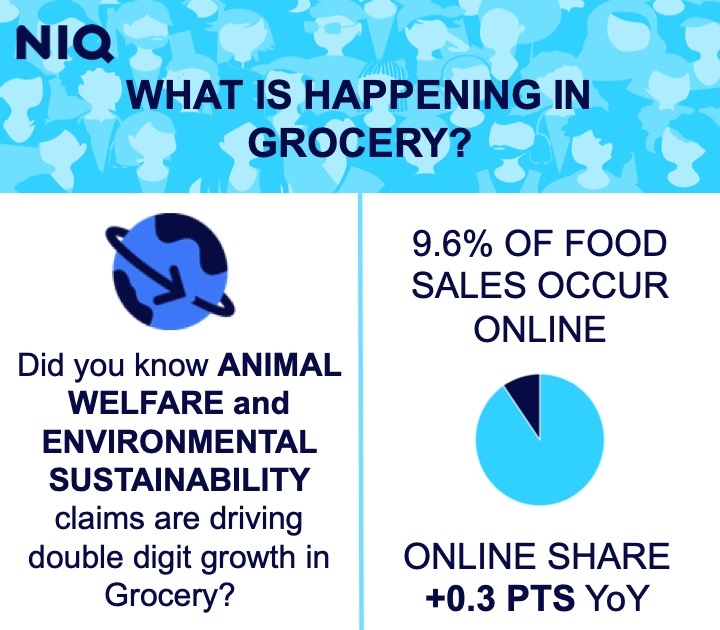

What’s Happening in Grocery?

What’s Happening in Performance Nutrition

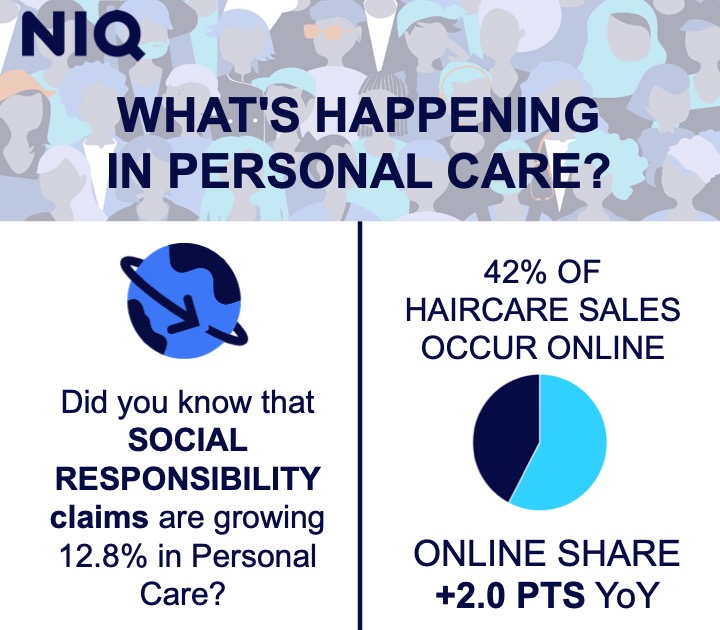

What’s Happening in Personal Care?

What’s Happening in Pet Care?

What’s Happening in Sweets & Snacks?

Never miss out on the big picture

Leverage the most comprehensive conventional, eCommerce, and Whole Foods Market item level data

Personal values and lifestyle preferences are driving consumer behavior today more than ever, outpacing the importance of foundational factors like price, availability, and brand loyalty.

Make data-driven decisions to sustain successful innovation and expand product lines. By gaining insights into the evolving consumer mindset and behavior patterns, you can better invest in growth.

Many successful emerging brands are using Byzzer, a data and insights platform designed for small businesses looking to accelerate growth, to outsmart their competitors – without overspending.

It is easy to use, affordable and gets you unlimited access to the support you need to get started.

Analyze Attribute Driven Sales Trends

Health and wellness isn’t just a channel anymore. All consumers are health and wellness consumers now and you need to keep up with changing consumer needs and product preferences. NielsenIQ has the information on the products you’ve bet on and info for the ones you’ll bet on in the future. As you go to market you can easily see and share the trends to drive distribution and sales. You can then also see the next trends to bet on whether that be adjacent categories, expansion within, etc.

Update identify retail distribution opportunity

Understand who is buying your products

Spot competitor moves and the next trends

Maximize your price and promotion